February is the weirdest month. It's shorter than the others, even if you account for that extra day which leaps in every few years. This is the month when winter rolls up its sleeves and gets down to work, cranking down temperatures and blowing snow all over your precious driveway. February boasts of hosting the Grammys and the SuperbOwl, two American festivals which are little seen and little regarded outside of this country. Well, maybe not the Grammys, but I feel they have lost their relevance compared to previous years. Valentine's Day shows up as well smack in the middle of the month, which is apparently celebrated as Cow Hug Day in India these days. The month also features two birthdays from this household, both within five days of each other and both of which I will sadly have to miss this year thanks to upcoming travel. |  | A superb owl |

| Here's to a short month and a shorter intro to this week's books and binges! | A book |  | The Books of Babel series by Josiah Bancroft |

| I have never been a fan of the steampunk genre, both in books and in movies. I've always found them confusing, with their emphasis on Victorian-era aesthetics, full of corsets, gas lamps, and gadgets made of wood, copper, and steel. So it was with some amount of trepidation that I started reading Senlin Ascends, the first in the Books of Babel series by Josiah Bancroft. However, the writing turned out to be excellent, and the fantasy yarn that Bancroft weaves goes beyond corsets and gadgets, though you do see a lot of the latter. The story centers around a mysterious structure called the Tower, visited by a school headmaster called Thomas Senlin, and his newly-wed wife Marya. They get separated before entering the tower, setting up the quest for Senlin which covers pretty much the entirety of the series. The world-building is fantastic, and the overall commentary on the nature of tyranny and despots in particular resonated with me. | The one complaint I had was that the intricate descriptions of gadgetry and the various kingdoms that form the tower take time to visualize, which honestly is not surprising for a work of fantasy. I enjoyed reading all four books, and would recommend them to anyone who is interested in world building and fantasy in general. | A movie |  | Jay Kelly on Netflix |

| If there's one thing that Hollywood loves, it's movies about itself. About its stars, the troubled writers, the auteur directors, the reclusive heroines, and oh the handsome men who wrestle with their inner demons yet put on a cheery smile in front of the camera. Netflix's Jay Kelly is about such a man, the dashingly debonair George Clooney seen here playing himself. | It is a pathetic excuse of a movie masquerading as high drama. It's made by Netflix after all, who instructs filmmakers to repeat their plots three to four times because their target audience is presumably distracted by their phones while watching. Adam Sandler is just about okay, Laura Dern, Billy Crudup and a few others have minor roles, and Clooney appears as himself in almost every scene. A painful, infuriating watch, with no sentimental value. Not recommended. | A show |  | Heated Rivalry on HBO/Crave |

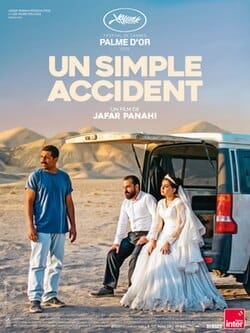

| Alright, let's get this out of the way, shall we? The show Heated Rivalry on HBO has a lot of sex. The show doesn't quite fade to black after a long kiss, or switch to two flowers gently brushing against each other either. The fade does happen, but the next scene features the same two people indulging in intense, passionate sex, shown in graphic detail. If that's not something you'd want to watch, then this show is probably not for you. However, you should know that sex in this show is not random titillation; it actually drives character development. The two leads learn about each other and, crucially, about themselves. It doesn't leave you feeling sleazy; it leaves you with a smile and a spring in your step, thankful for some romance in the world. | The show is based on the second in a series of books called The Game Changers, by Canadian author Rachel Reid. The backdrop is the fictional major hockey league called, well, Major League Hockey (MLH), where two rookie players get drafted into Montreal and Boston (yay) sports franchises. They play against each other, with each other, and develop feelings for each other. It's well-written, brilliantly shot, and has two of the hottest young actors to grace TV screens. Recommended. | Coming Up | |  | It Was Just An Accident |

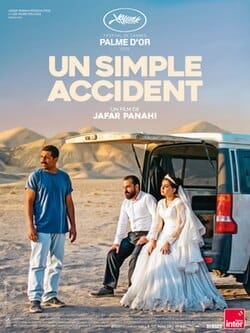

| | Have a great week!

We are a month into this newsletter now (!!), hoping no one's noticed the week that was skipped over. Thanks to all nineteen of you who cared enough to hit the subscribe link, and the three who were added without their consent but still haven't cancelled, being the good wife and children they are. Speaking of, how do you folks pick the content you consume? Is it recos from friends? Critics you like? Subreddits, podcasts, blogs, vlogs, newspapers, that weird aunt who vaguely smells of ginger and garlic and has a thing for Russian playwrights? I get mine from all the above, and am constantly on the lookout for more. I am a big fan of the Pop Culture Happy Hour podcast from NPR for instance, and while I may not always agree with their views, the pop culture artifacts they review are almost always worth a look. I also have this self-imposed "minimum consumption time" for art. It's usually the first thirty pages for a book, though there are times when I've given up after the first two hundred (I'm looking at you, book eight of Malazan Book of the Fallen). With a movie it's usually the first five to ten minutes, as most movies introduce themselves fairly well in that timeframe. I have found that a lot of the Hindi movies from the last few years do not last more than five minutes, though. Your mileage may vary, of course. I try to watch the entire first episode of a show before giving up, as shows often have a twist or a gimme-more gimmick at the end of the pilot - a hook that's supposed to make you quickly click on the 'Next Episode' button. The first episode of Paradise is a great example, if you want to try one out. Alright, on to this week's books and binges! A book | Hitman Omnibus Edition, Vol 1 |

My introduction to Garth Ennis was through the groundbreaking Preacher series, the one that took a chainsaw to your concept of Christianity, God, and Texas, not necessarily in that order. I had found it explosively funny at the time, and an ode to male bonding and friendship. I don't think it holds up as well now though, but it still remains one of the most prized comic book series in my collection. I then went on to read Ennis' run on Punisher MAX (vicious, brutal, testosterone-pumping) and The Boys (superheroes get the chainsaw this time around), and liked them too. I could spot his recurring themes by then: nihilism, cynicism, grit, war, Ireland, dark humor, and tough men making tough choices. Hitman has all of the above, with the humor and camaraderie dialed up. The main character is Tommy Monaghan, a hitman who could have been at home in the pulp novels we discussed in the previous newsletter, with his hard-boiled character, laconic outlook, and x-ray vision plus telepathy thrown in as bonus. He lives in the DC universe, which allows Ennis to bring in some of their best known characters and take the piss out of each one of them. With the possible exception of Superman, who is the one superhero Ennis hasn't really skewered. I should confess that I have not yet read Vol 2 of the Omnibus, which I'm told is even better than the first, but I mean to correct that shortly. Recommended. A movie | Su From So (Kannada, on Hulu/Jio Hotstar) |

There is a particular genre of movies, especially in Indian cinema, which centers around the village. We like them because they remind us of an innocent, simple, happy past - one which never really existed, truth be told. We were young then, not exposed to problematic issues of caste, bigotry, and misogyny, and lived inside a protective bubble created by our parents. That said, years later, we need those moments of innocence, particularly now when everything around appears sordid and malevolent. I would happily go back and rewatch a Peruvannapurathe Visheshangal on a Friday night after another week of soul-crushing brought on solely by reading the news. Su from So is that kind of movie. It's the directorial debut of JP Thuminad, and does not feature any major stars (as far as I could tell). Set in a coastal village in Karnataka, it has a bunch of characters who are not quite the stereotypes you'd expect. The humor is lighthearted, the plot takes a shape of its own as the characters develop, and it's just emotional enough to leave an impact. The subtitles are thankfully not trite, and you do not need to know Kannada to enjoy the film. You finish the movie with a smile on your face, reminding you to ask your mom to watch it if she is able. Recommended. A show  | Delhi Crime (Hindi, Netflix) |

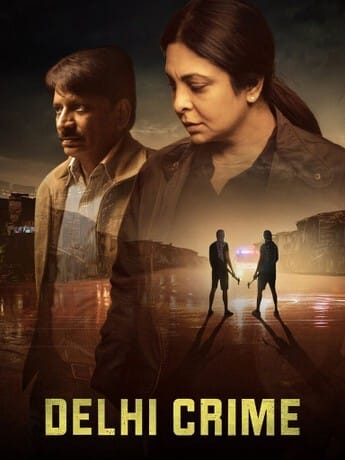

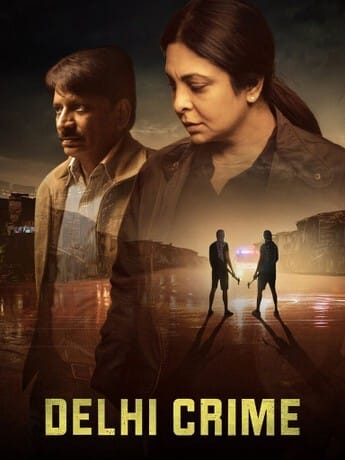

Let's go back to malevolence, shall we? If you were in India in 2012, or reading news about India in 2012, you would know what I mean. The Nirbhaya case remains a watershed moment in Indian history - probably the first time the entire nation raised its voice against violence towards women. There have been numerous similar incidents later on, almost numbing our collective consciousness, but this one still lingers. The Deputy Commissioner of Police who led the Special Investigation Team tasked with solving the crime was Chhaya Sharma, already known for her work in investigating the Baby Falak case and exposing the human trafficking network that enabled it. Her bio is outstanding, if you want to check it out. Delhi Crime Season One is all about the Nirbhaya case, and is a banger of a procedural. It stars Shefali Shah as DCP Vartika Chaturvedi (stand-in for DCP Sharma), the ever-dependable Rajesh Tailang as her second-in-command, and a host of other actors who flesh out the characters they portray with remarkable zeal. I was particularly fond of the tenacious cop Sudhir (played by Gopal Dutt) who takes time to talk with victims and passers-by, searching for any possible clue that would help the investigation. The show does not veer into theatrics and pretty much stays the course of a good cop show featuring humanized police doing their job. This was true of the second season as well, where the plot was about a gang terrorizing the elderly in Delhi. I felt the third season, based on the Baby Falak case, faltered a bit with its plot despite adding two good actors in Mita Vashisht and Huma Qureshi. I'd recommend the first two seasons, but don't go into the third expecting the same. Coming Up Have a great week!

Ever since moving to Massachusetts, I constantly complain about the winter. It's too long, running for a solid six months from November through April. It's bitterly cold, with temperatures dipping into negative territory - in Fahrenheit - every January and February. Shoveling snow is literally a pain in the backside even if you use a snowblower, and that too one which obstinately refuses to turn its head when you need it. |  | Massachusetts Man endures pain trying to maneuver an obstinate snowblower |

| And yet. And yet there are some days when you stand near the window overlooking your backyard, cuppa in hand, stunned. | | I know I will keep complaining about winter, about the cold, the frigid air. But I am also thankful for moments like these which I do not want to ever take for granted. | Alright, on to this week's books and binges! | A Book | | You already know what Enshittification is about - the title is pretty much self-explanatory. Cory Doctorow talks about how almost all tech platforms deteriorate over time: first, they are good to their users. Next, they throw users under the bus to bring in business customers. Third, they throw those customers under the bus to make a ton of money for themselves. He provides examples from all the companies you can think of (Facebook, Amazon, Google), and walks through the process with data and examples to back up his theory. Unlike a lot of other books though, he provides a couple of ways to solve this problem, through the right of exit and the end-to-end principle. The book is oriented towards (or perhaps against) the tech industry, but I would wholeheartedly recommend it to everyone. You do not need a tech background to feel angry as you read, and a teeny bit hopeful as you finish. | A Movie | | So, about the French. I use the term loosely, as some of these folks are not, strictly speaking, of French origin, though their most famous films have been in the language. I have not come close to watching their entire filmography but I have absolutely loved the ones I've seen of Truffaut, Renoir, Melville, Varda, Tati, and our homme du jour, Godard. I'd actually watched the American remake of Breathless (Richard Gere) before I watched the original (Belmondo). And since you might ask, no, please don't bother. The French New Wave (or Nouvelle Vague, as you might have guessed), emerged in the 50s and was championed by some of these auteurs, stemming from the magazine Cahiers du Cinéma. | All this to say that the Richard Linklater creation Nouvelle Vague on Netflix is an ode to these movies. It's a lovely, fun film about film. About art. About Godard for sure, but also about creating something totally new, going against established norms and expectations. It's shot similar to the movies of that era, in black and white and in French. I watched the entire film with a big stupid smile on my face, in love with the movies all over again. Highly recommended. | A Show | | I grew up on a diet of all genres, but one that I enjoyed the most was pulp. You know, books written by folks like John D McDonald, Elmore Leonard, Ed McBain, Robert B Parker, and if you go back a bit more, Jim Thompson. They usually have covers with fonts like the one below, and feature all the usual noir elements - a woman (sultry), a man (hard boiled), and a twisty, winding, often incomprehensible plot (unimportant). | | The Lowdown is in the same vein, with a dash of humor thrown in. It features an incredible Ethan Hawke playing a "truthstorian" in Tulsa, Oklahoma, a white man who cares (the worst type, according to a few characters in the show). Its plot takes several twists and turns, people aren't who they seem (but of course), and you are not quite sure if every loose thread was wrapped up at the end. But you enjoyed the ride. Recommended. | Coming Up | | | Have a great week!

We made it to week two! Thanks to all of you who clicked on the subscribe link and wound up finding this post in your mail. So to speak. I have been following a few artists/writers on Instagram for several years, especially since I jumped ship from Twitter. Folks like Brian K. Vaughan, Jeff Lemire, Stephen King, and Pia Guerra. Pia has been doing editorial cartooning for over fifteen years now, contributing to The New Yorker, The Washington Post, and the occasional MAD Magazine issue. She is better known though for her breakout work on Y: The Last Man, collaborating with Brian K. Vaughan. Y was the first comic series that I ever read from start to finish, and has stayed a firm favorite. So, when Pia announced a year-end clearance sale of some of her pages, I couldn't resist. I got in touch with her, paid for a page after consulting with Satya, and carefully unwrapped it yesterday. I don't usually collect comic art, but this felt special.  | The published & the original |

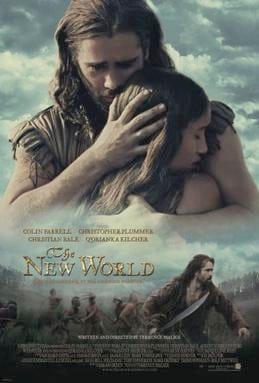

Alright, on to this week's books and binges! A bookKaren Hao's Empire of AI: Dreams and Nightmares in Sam Altman's OpenAI covers pretty much what it says on the tin. It's incredibly well-researched, diving deep into the environmental costs of AI as well as the human element. I hadn't fully considered the colonialism aspect she highlights, specifically the labor and economic impacts on the Global South, which was an eye-opener. It reads like a book written by an engineer-turned-journalist (which is exactly what she is). The tech is interesting, as are the machinations behind closed doors. Highly recommended, no matter where you stand on AI and its implications. A movie I've always tiptoed around Terrence Malick's work, worried it might be a bit too slow or dense for me. That changed last September when I watched Days of Heaven and was completely blown away. I probably should have moved on to Badlands or The Tree of Life, but I'd recently snagged the Criterion edition of The New World, so I settled in for that instead. It features a stellar cast, with Christopher Plummer, Colin Farrell, Christian Bale, and Q'orianka Kilcher. The movie is gorgeously shot - just astounding, poetic in its appeal. It's also... a bit plodding? Parts of it actually reminded me of Indian films like Hum Dil De Chuke Sanam or Mani Ratnam's Mouna Ragam. Even with the slow pace, I'd recommend it for the visuals alone; it's basically poetry on film. A show It's a truth universally acknowledged that if you're the son of a pathologist and married to another, you're going to end up watching a lot of crime procedurals. Luckily, the genre has produced some of the best TV ever made. I don't know if Blue Lights is quite at the very top of that list, but it's pretty damn close. Set in Belfast, it follows a group of rookie cops dealing with organized (and disorganized) crime. The characters are well-defined, the plot is highly engaging, and it never insults your intelligence. I've watched all the three seasons that have been released so far, and cannot wait for the next. It might be hard to find on your favorite streaming service unless you are in the UK, but it's absolutely worth the search. I wouldn't have stumbled across it if Mujib hadn't mentioned it. Highly recommended. Coming Up Have a great week!

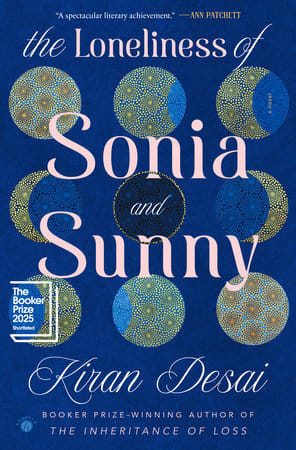

So, I have been mulling over this for a while. Last year was when I experimented with posting screenshots of the books I read (on Whatsapp), and brief takes on the movies and shows I watched ( Bluesky). I was honestly surprised when a few folks responded to these takes, and asked me for recommendations. | Now my system so far when I get these requests has been to turn it back to the person and ask them to list the last three books (or movies) that they enjoyed, which would help me think of similar books which I could recommend. However, Sindha, who keeps me sane (most of the time), gently informed me that people hate doing this. They just want a reco which they could then decide to try out - or not. I was backing them into a corner by asking them their preferences, which was what they wanted to avoid thinking about in the first place. | The second related thing that happened last year was when I had dinner with a few friends and got into conversations about books, movies, and TV shows. I spoke about Slow Horses. About Murderbot. somebody somewhere. My friends asked me to write about these shows and tell them about it. | These two instances made me do the mulling bit I spoke about earlier. Which led to thinking about an email format, in what was called the year of the newsletter. Substack was a no, which made me consider beehiiv, with a setting to automatically post to my blog as well just to keep that mostly ignored thing alive. | Let's try this out, shall we? The idea is to list a book, a movie, and a show that I consumed. You will not need to pay anything to subscribe of course, and I intend to do this every week (ish). Let me know what works and what makes your eyes glaze over, please. | Off we go! | A Book | | Kiran Desai's The Loneliness of Sonia and Sunny is a novel that really gets into the heads of its two main characters as they navigate the disconnection that accompanies an immigrant experience. I could relate to how this fuels their feelings of isolation, their fragmented sense of self, the hopes and letdown that come with seeking a new identity. That said, the book was overlong and there was a point where I wanted the damn thing to end. I had purchased the hardcover and could skip my dumbbell workout when I was reading it. I wanted to like this book, I really did. I wound up putting it on my shelf with a sigh of relief at the end. Not recommended. | A Movie | | Kishkindha Kaandam was my favorite Malayalam movie of 2024, so I knew I had to watch the new film by the same folks b. Eko is written and shot by Bahul Ramesh, and directed by Dinjith Ayyathan, two people I still don't know much about but whose careers I plan to follow with interest. Eko is supposedly the final installment of Ramesh's Animal Trilogy, following Kishkindha Kaandam and Kerala Crime Files (the TV show). This is one of those movies which you need to experience yourself, going in as blind as possible. It has a lot to do with dogs, if you must know. I liked it quite a bit despite a few misgivings, and plan to watch it again sometime soon. Recommended. | A Show | | The Beast In Me has Claire Danes, she of the quivering lip, and Matthew Rhys, with his steady Russian/American smirk, playing two unlikeable characters doing unlikeable things - not to each other though, thankfully. It leans heavily into the "suburban noir" feel with lots of tension, good cinematography, and that constant feeling that everyone is hiding something behind their polished front doors. Rich white-people problems, mostly. I wound up liking it but will stop short of recommending it as it does fall into the trashy category. And that quiver from Danes can get grating quickly. | Coming Up |  | The Tower of Babel series by Josiah Bancroft |

|  | Playing on Hulu/Disney/FX/your favorite torrent site |

|  | On Netflix |

| Have a great week! |

|